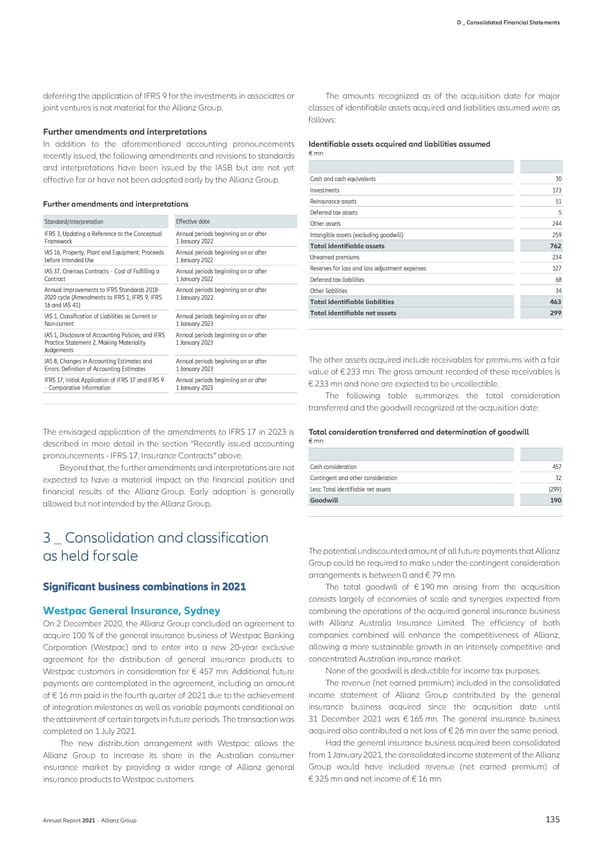

D _ Consolidated Financial Statements deferring the application of IFRS 9 for the investments in associates or The amounts recognized as of the acquisition date for major joint ventures is not material for the Allianz Group. classes of identifiable assets acquired and liabilities assumed were as follows: Further amendments and interpretations In addition to the aforementioned accounting pronouncements Identifiable assets acquired and liabilities assumed recently issued, the following amendments and revisions to standards € mn and interpretations have been issued by the IASB but are not yet effective for or have not been adopted early by the Allianz Group. Cash and cash equivalents 30 Investments 173 Further amendments and interpretations Reinsurance assets 51 Deferred tax assets 5 Standard/Interpretation Effective date Other assets 244 IFRS 3, Updating a Reference to the Conceptual Annual periods beginning on or after Intangible assets (excluding goodwill) 259 Framework 1 January 2022 Total identifiable assets 762 IAS 16, Property, Plant and Equipment: Proceeds Annual periods beginning on or after Unearned premiums 234 before Intended Use 1 January 2022 IAS 37, Onerous Contracts – Cost of Fulfilling a Annual periods beginning on or after Reserves for loss and loss adjustment expenses 127 Contract 1 January 2022 Deferred tax liabilities 68 Annual Improvements to IFRS Standards 2018– Annual periods beginning on or after Other liabilities 34 2020 cycle (Amendments to IFRS 1, IFRS 9, IFRS 1 January 2022 Total identifiable liabilities 463 16 and IAS 41) IAS 1, Classification of Liabilities as Current or Annual periods beginning on or after Total identifiable net assets 299 Non-current 1 January 2023 IAS 1, Disclosure of Accounting Policies, and IFRS Annual periods beginning on or after Practice Statement 2, Making Materiality 1 January 2023 Judgements IAS 8, Changes in Accounting Estimates and Annual periods beginning on or after The other assets acquired include receivables for premiums with a fair Errors: Definition of Accounting Estimates 1 January 2023 value of € 233 mn. The gross amount recorded of these receivables is IFRS 17, Initial Application of IFRS 17 and IFRS 9 Annual periods beginning on or after € 233 mn and none are expected to be uncollectible. – Comparative Information 1 January 2023 The following table summarizes the total consideration transferred and the goodwill recognized at the acquisition date: The envisaged application of the amendments to IFRS 17 in 2023 is Total consideration transferred and determination of goodwill described in more detail in the section “Recently issued accounting € mn pronouncements - IFRS 17, Insurance Contracts” above. Beyond that, the further amendments and interpretations are not Cash consideration 457 expected to have a material impact on the financial position and Contingent and other consideration 32 financial results of the Allianz Group. Early adoption is generally Less: Total identifiable net assets (299) allowed but not intended by the Allianz Group. Goodwill 190 3 _ Consolidation and classification as held for sale The potential undiscounted amount of all future payments that Allianz Group could be required to make under the contingent consideration arrangements is between 0 and € 79 mn. The total goodwill of € 190 mn arising from the acquisition consists largely of economies of scale and synergies expected from Westpac General Insurance, Sydney combining the operations of the acquired general insurance business On 2 December 2020, the Allianz Group concluded an agreement to with Allianz Australia Insurance Limited. The efficiency of both acquire 100 % of the general insurance business of Westpac Banking companies combined will enhance the competitiveness of Allianz, Corporation (Westpac) and to enter into a new 20-year exclusive allowing a more sustainable growth in an intensely competitive and agreement for the distribution of general insurance products to concentrated Australian insurance market. Westpac customers in consideration for € 457 mn. Additional future None of the goodwill is deductible for income tax purposes. payments are contemplated in the agreement, including an amount The revenue (net earned premium) included in the consolidated of € 16 mn paid in the fourth quarter of 2021 due to the achievement income statement of Allianz Group contributed by the general of integration milestones as well as variable payments conditional on insurance business acquired since the acquisition date until the attainment of certain targets in future periods. The transaction was 31 December 2021 was € 165 mn. The general insurance business completed on 1 July 2021. acquired also contributed a net loss of € 26 mn over the same period. The new distribution arrangement with Westpac allows the Had the general insurance business acquired been consolidated Allianz Group to increase its share in the Australian consumer from 1 January 2021, the consolidated income statement of the Allianz insurance market by providing a wider range of Allianz general Group would have included revenue (net earned premium) of insurance products to Westpac customers. € 325 mn and net income of € 16 mn. Annual Report 2021 − Allianz Group 135

Non-financial Statement Page 136 Page 138

Non-financial Statement Page 136 Page 138