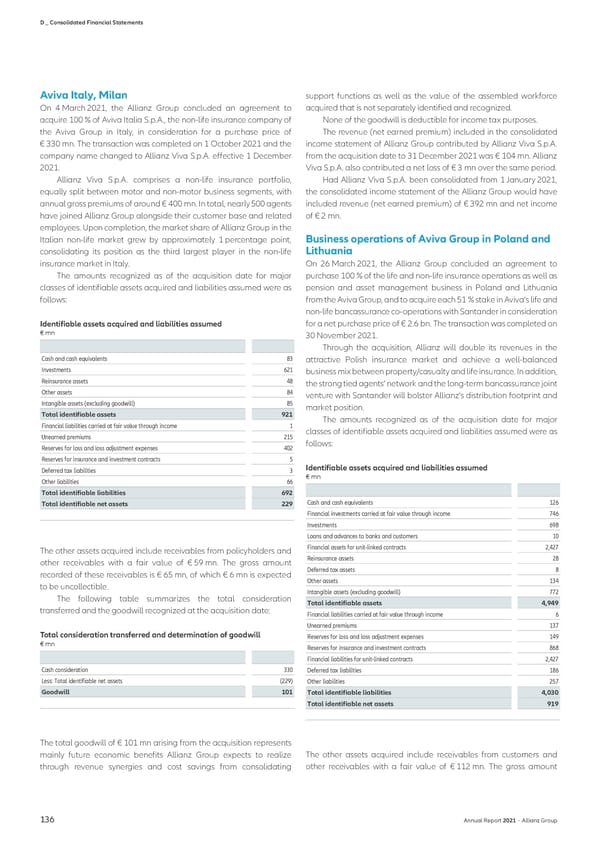

D _ Consolidated Financial Statements Aviva Italy, Milan support functions as well as the value of the assembled workforce On 4 March 2021, the Allianz Group concluded an agreement to acquired that is not separately identified and recognized. acquire 100 % of Aviva Italia S.p.A., the non-life insurance company of None of the goodwill is deductible for income tax purposes. the Aviva Group in Italy, in consideration for a purchase price of The revenue (net earned premium) included in the consolidated € 330 mn. The transaction was completed on 1 October 2021 and the income statement of Allianz Group contributed by Allianz Viva S.p.A. company name changed to Allianz Viva S.p.A. effective 1 December from the acquisition date to 31 December 2021 was € 104 mn. Allianz 2021. Viva S.p.A. also contributed a net loss of € 3 mn over the same period. Allianz Viva S.p.A. comprises a non-life insurance portfolio, Had Allianz Viva S.p.A. been consolidated from 1 January 2021, equally split between motor and non-motor business segments, with the consolidated income statement of the Allianz Group would have annual gross premiums of around € 400 mn. In total, nearly 500 agents included revenue (net earned premium) of € 392 mn and net income have joined Allianz Group alongside their customer base and related of € 2 mn. employees. Upon completion, the market share of Allianz Group in the Italian non-life market grew by approximately 1 percentage point, Business operations of Aviva Group in Poland and consolidating its position as the third largest player in the non-life Lithuania insurance market in Italy. On 26 March 2021, the Allianz Group concluded an agreement to The amounts recognized as of the acquisition date for major purchase 100 % of the life and non-life insurance operations as well as classes of identifiable assets acquired and liabilities assumed were as pension and asset management business in Poland and Lithuania follows: from the Aviva Group, and to acquire each 51 % stake in Aviva’s life and non-life bancassurance co-operations with Santander in consideration Identifiable assets acquired and liabilities assumed for a net purchase price of € 2.6 bn. The transaction was completed on € mn 30 November 2021. Through the acquisition, Allianz will double its revenues in the Cash and cash equivalents 83 attractive Polish insurance market and achieve a well-balanced Investments 621 business mix between property/casualty and life insurance. In addition, Reinsurance assets 48 the strong tied agents’ network and the long-term bancassurance joint Other assets 84 venture with Santander will bolster Allianz’s distribution footprint and Intangible assets (excluding goodwill) 85 market position. Total identifiable assets 921 The amounts recognized as of the acquisition date for major Financial liabilities carried at fair value through income 1 classes of identifiable assets acquired and liabilities assumed were as Unearned premiums 215 follows: Reserves for loss and loss adjustment expenses 402 Reserves for insurance and investment contracts 5 Deferred tax liabilities 3 Identifiable assets acquired and liabilities assumed Other liabilities 66 € mn Total identifiable liabilities 692 Total identifiable net assets 229 Cash and cash equivalents 126 Financial investments carried at fair value through income 746 Investments 698 Loans and advances to banks and customers 10 The other assets acquired include receivables from policyholders and Financial assets for unit-linked contracts 2,427 other receivables with a fair value of € 59 mn. The gross amount Reinsurance assets 28 recorded of these receivables is € 65 mn, of which € 6 mn is expected Deferred tax assets 8 to be uncollectible. Other assets 134 The following table summarizes the total consideration Intangible assets (excluding goodwill) 772 Total identifiable assets 4,949 transferred and the goodwill recognized at the acquisition date: Financial liabilities carried at fair value through income 6 Unearned premiums 137 Total consideration transferred and determination of goodwill Reserves for loss and loss adjustment expenses 149 € mn Reserves for insurance and investment contracts 868 Financial liabilities for unit-linked contracts 2,427 Cash consideration 330 Deferred tax liabilities 186 Less: Total identifiable net assets (229) Other liabilities 257 Goodwill 101 Total identifiable liabilities 4,030 Total identifiable net assets 919 The total goodwill of € 101 mn arising from the acquisition represents mainly future economic benefits Allianz Group expects to realize The other assets acquired include receivables from customers and through revenue synergies and cost savings from consolidating other receivables with a fair value of € 112 mn. The gross amount 136 Annual Report 2021 − Allianz Group

Non-financial Statement Page 137 Page 139

Non-financial Statement Page 137 Page 139