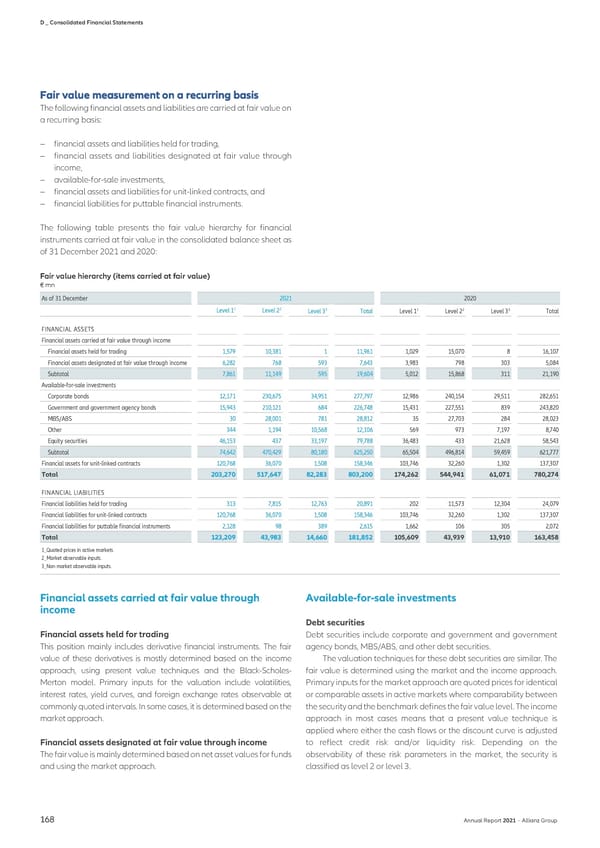

D _ Consolidated Financial Statements The following financial assets and liabilities are carried at fair value on a recurring basis: − financial assets and liabilities held for trading, − financial assets and liabilities designated at fair value through income, − available-for-sale investments, − financial assets and liabilities for unit-linked contracts, and − financial liabilities for puttable financial instruments. The following table presents the fair value hierarchy for financial instruments carried at fair value in the consolidated balance sheet as of 31 December 2021 and 2020: Fair value hierarchy (items carried at fair value) € mn As of 31 December 2021 2020 1 2 3 1 2 3 Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total FINANCIAL ASSETS Financial assets carried at fair value through income Financial assets held for trading 1,579 10,381 1 11,961 1,029 15,070 8 16,107 Financial assets designated at fair value through income 6,282 768 593 7,643 3,983 798 303 5,084 Subtotal 7,861 11,149 595 19,604 5,012 15,868 311 21,190 Available-for-sale investments Corporate bonds 12,171 230,675 34,951 277,797 12,986 240,154 29,511 282,651 Government and government agency bonds 15,943 210,121 684 226,748 15,431 227,551 839 243,820 MBS/ABS 30 28,001 781 28,812 35 27,703 284 28,023 Other 344 1,194 10,568 12,106 569 973 7,197 8,740 Equity securities 46,153 437 33,197 79,788 36,483 433 21,628 58,543 Subtotal 74,642 470,429 80,180 625,250 65,504 496,814 59,459 621,777 Financial assets for unit-linked contracts 120,768 36,070 1,508 158,346 103,746 32,260 1,302 137,307 Total 203,270 517,647 82,283 803,200 174,262 544,941 61,071 780,274 FINANCIAL LIABILITIES Financial liabilities held for trading 313 7,815 12,763 20,891 202 11,573 12,304 24,079 Financial liabilities for unit-linked contracts 120,768 36,070 1,508 158,346 103,746 32,260 1,302 137,307 Financial liabilities for puttable financial instruments 2,128 98 389 2,615 1,662 106 305 2,072 Total 123,209 43,983 14,660 181,852 105,609 43,939 13,910 163,458 1_Quoted prices in active markets. 2_Market observable inputs. 3_Non-market observable inputs. Financial assets carried at fair value through Available-for-sale investments income Debt securities Financial assets held for trading Debt securities include corporate and government and government This position mainly includes derivative financial instruments. The fair agency bonds, MBS/ABS, and other debt securities. value of these derivatives is mostly determined based on the income The valuation techniques for these debt securities are similar. The approach, using present value techniques and the Black-Scholes- fair value is determined using the market and the income approach. Merton model. Primary inputs for the valuation include volatilities, Primary inputs for the market approach are quoted prices for identical interest rates, yield curves, and foreign exchange rates observable at or comparable assets in active markets where comparability between commonly quoted intervals. In some cases, it is determined based on the the security and the benchmark defines the fair value level. The income market approach. approach in most cases means that a present value technique is applied where either the cash flows or the discount curve is adjusted Financial assets designated at fair value through income to reflect credit risk and/or liquidity risk. Depending on the The fair value is mainly determined based on net asset values for funds observability of these risk parameters in the market, the security is and using the market approach. classified as level 2 or level 3. 168 Annual Report 2021 − Allianz Group

Non-financial Statement Page 169 Page 171

Non-financial Statement Page 169 Page 171