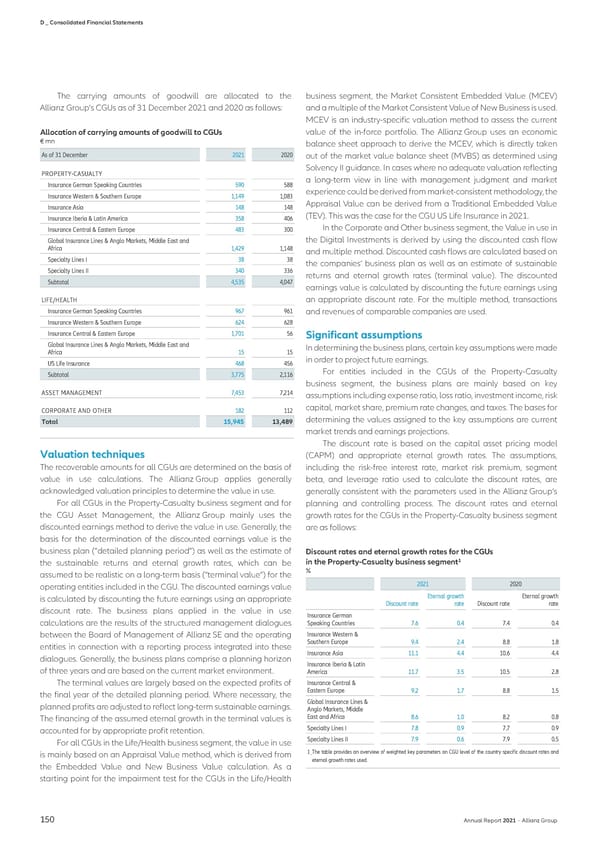

D _ Consolidated Financial Statements The carrying amounts of goodwill are allocated to the business segment, the Market Consistent Embedded Value (MCEV) Allianz Group’s CGUs as of 31 December 2021 and 2020 as follows: and a multiple of the Market Consistent Value of New Business is used. MCEV is an industry-specific valuation method to assess the current Allocation of carrying amounts of goodwill to CGUs value of the in-force portfolio. The Allianz Group uses an economic € mn balance sheet approach to derive the MCEV, which is directly taken As of 31 December 2021 2020 out of the market value balance sheet (MVBS) as determined using PROPERTY-CASUALTY Solvency II guidance. In cases where no adequate valuation reflecting Insurance German Speaking Countries 590 588 a long-term view in line with management judgment and market Insurance Western & Southern Europe 1,149 1,083 experience could be derived from market-consistent methodology, the Insurance Asia 148 148 Appraisal Value can be derived from a Traditional Embedded Value Insurance Iberia & Latin America 358 406 (TEV). This was the case for the CGU US Life Insurance in 2021. Insurance Central & Eastern Europe 483 300 In the Corporate and Other business segment, the Value in use in Global Insurance Lines & Anglo Markets, Middle East and the Digital Investments is derived by using the discounted cash flow Africa 1,429 1,148 and multiple method. Discounted cash flows are calculated based on Specialty Lines I 38 38 the companies‘ business plan as well as an estimate of sustainable Specialty Lines II 340 336 returns and eternal growth rates (terminal value). The discounted Subtotal 4,535 4,047 earnings value is calculated by discounting the future earnings using LIFE/HEALTH an appropriate discount rate. For the multiple method, transactions Insurance German Speaking Countries 967 961 and revenues of comparable companies are used. Insurance Western & Southern Europe 624 628 Insurance Central & Eastern Europe 1,701 56 Significant assumptions Global Insurance Lines & Anglo Markets, Middle East and In determining the business plans, certain key assumptions were made Africa 15 15 US Life Insurance 468 456 in order to project future earnings. Subtotal 3,775 2,116 For entities included in the CGUs of the Property-Casualty business segment, the business plans are mainly based on key ASSET MANAGEMENT 7,453 7,214 assumptions including expense ratio, loss ratio, investment income, risk CORPORATE AND OTHER 182 112 capital, market share, premium rate changes, and taxes. The bases for Total 15,945 13,489 determining the values assigned to the key assumptions are current market trends and earnings projections. The discount rate is based on the capital asset pricing model Valuation techniques (CAPM) and appropriate eternal growth rates. The assumptions, The recoverable amounts for all CGUs are determined on the basis of including the risk-free interest rate, market risk premium, segment value in use calculations. The Allianz Group applies generally beta, and leverage ratio used to calculate the discount rates, are acknowledged valuation principles to determine the value in use. generally consistent with the parameters used in the Allianz Group’s For all CGUs in the Property-Casualty business segment and for planning and controlling process. The discount rates and eternal the CGU Asset Management, the Allianz Group mainly uses the growth rates for the CGUs in the Property-Casualty business segment discounted earnings method to derive the value in use. Generally, the are as follows: basis for the determination of the discounted earnings value is the business plan (“detailed planning period”) as well as the estimate of Discount rates and eternal growth rates for the CGUs 1 the sustainable returns and eternal growth rates, which can be in the Property-Casualty business segment assumed to be realistic on a long-term basis (“terminal value”) for the % operating entities included in the CGU. The discounted earnings value 2021 2020 is calculated by discounting the future earnings using an appropriate Eternal growth Eternal growth Discount rate rate Discount rate rate discount rate. The business plans applied in the value in use Insurance German calculations are the results of the structured management dialogues Speaking Countries 7.6 0.4 7.4 0.4 between the Board of Management of Allianz SE and the operating Insurance Western & entities in connection with a reporting process integrated into these Southern Europe 9.4 2.4 8.8 1.8 dialogues. Generally, the business plans comprise a planning horizon Insurance Asia 11.1 4.4 10.6 4.4 of three years and are based on the current market environment. Insurance Iberia & Latin America 11.7 3.5 10.5 2.8 The terminal values are largely based on the expected profits of Insurance Central & the final year of the detailed planning period. Where necessary, the Eastern Europe 9.2 1.7 8.8 1.5 planned profits are adjusted to reflect long-term sustainable earnings. Global Insurance Lines & Anglo Markets, Middle The financing of the assumed eternal growth in the terminal values is East and Africa 8.6 1.0 8.2 0.8 accounted for by appropriate profit retention. Specialty Lines I 7.8 0.9 7.7 0.9 For all CGUs in the Life/Health business segment, the value in use Specialty Lines II 7.9 0.6 7.9 0.5 is mainly based on an Appraisal Value method, which is derived from 1_The table provides an overview of weighted key parameters on CGU level of the country-specific discount rates and the Embedded Value and New Business Value calculation. As a eternal growth rates used. starting point for the impairment test for the CGUs in the Life/Health 150 Annual Report 2021 − Allianz Group

Non-financial Statement Page 151 Page 153

Non-financial Statement Page 151 Page 153