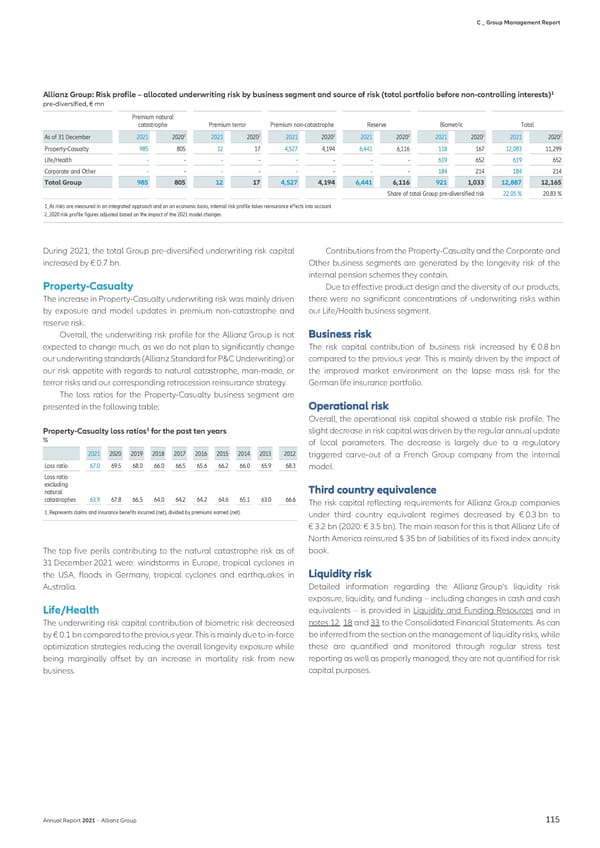

C _ Group Management Report 1 Allianz Group: Risk profile – allocated underwriting risk by business segment and source of risk (total portfolio before non-controlling interests) pre-diversified, € mn Premium natural catastrophe Premium terror Premium non-catastrophe Reserve Biometric Total 2 2 2 2 2 2 As of 31 December 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 Property-Casualty 985 805 12 17 4,527 4,194 6,441 6,116 118 167 12,083 11,299 Life/Health - - - - - - - - 619 652 619 652 Corporate and Other - - - - - - - - 184 214 184 214 Total Group 985 805 12 17 4,527 4,194 6,441 6,116 921 1,033 12,887 12,165 Share of total Group pre-diversified risk 22.05 % 20.83 % 1_As risks are measured in an integrated approach and on an economic basis, internal risk profile takes reinsurance effects into account. 2_2020 risk profile figures adjusted based on the impact of the 2021 model changes. During 2021, the total Group pre-diversified underwriting risk capital Contributions from the Property-Casualty and the Corporate and increased by € 0.7 bn. Other business segments are generated by the longevity risk of the internal pension schemes they contain. Property-Casualty Due to effective product design and the diversity of our products, The increase in Property-Casualty underwriting risk was mainly driven there were no significant concentrations of underwriting risks within by exposure and model updates in premium non-catastrophe and our Life/Health business segment. reserve risk. Overall, the underwriting risk profile for the Allianz Group is not expected to change much, as we do not plan to significantly change The risk capital contribution of business risk increased by € 0.8 bn our underwriting standards (Allianz Standard for P&C Underwriting) or compared to the previous year. This is mainly driven by the impact of our risk appetite with regards to natural catastrophe, man-made, or the improved market environment on the lapse mass risk for the terror risks and our corresponding retrocession reinsurance strategy. German life insurance portfolio. The loss ratios for the Property-Casualty business segment are presented in the following table: Overall, the operational risk capital showed a stable risk profile. The 1 slight decrease in risk capital was driven by the regular annual update Property-Casualty loss ratios for the past ten years % of local parameters. The decrease is largely due to a regulatory 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 triggered carve-out of a French Group company from the internal Loss ratio 67.0 69.5 68.0 66.0 66.5 65.6 66.2 66.0 65.9 68.3 model. Loss ratio excluding natural catastrophes 63.9 67.8 66.5 64.0 64.2 64.2 64.6 65.1 63.0 66.6 The risk capital reflecting requirements for Allianz Group companies 1_Represents claims and insurance benefits incurred (net), divided by premiums earned (net). under third country equivalent regimes decreased by € 0.3 bn to € 3.2 bn (2020: € 3.5 bn). The main reason for this is that Allianz Life of North America reinsured $ 35 bn of liabilities of its fixed index annuity The top five perils contributing to the natural catastrophe risk as of book. 31 December 2021 were: windstorms in Europe, tropical cyclones in the USA, floods in Germany, tropical cyclones and earthquakes in Australia. Detailed information regarding the Allianz Group’s liquidity risk exposure, liquidity, and funding – including changes in cash and cash Life/Health equivalents – is provided in Liquidity and Funding Resources and in The underwriting risk capital contribution of biometric risk decreased notes 12, 18 and 33 to the Consolidated Financial Statements. As can by € 0.1 bn compared to the previous year. This is mainly due to in-force be inferred from the section on the management of liquidity risks, while optimization strategies reducing the overall longevity exposure while these are quantified and monitored through regular stress test being marginally offset by an increase in mortality risk from new reporting as well as properly managed, they are not quantified for risk business. capital purposes. Annual Report 2021 − Allianz Group 115

Non-financial Statement Page 116 Page 118

Non-financial Statement Page 116 Page 118