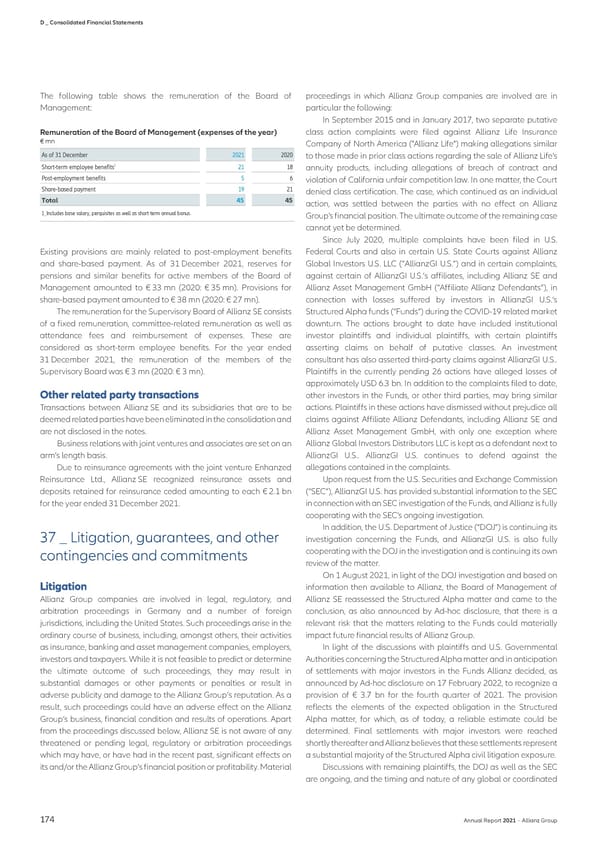

D _ Consolidated Financial Statements The following table shows the remuneration of the Board of proceedings in which Allianz Group companies are involved are in Management: particular the following: In September 2015 and in January 2017, two separate putative Remuneration of the Board of Management (expenses of the year) class action complaints were filed against Allianz Life Insurance € mn Company of North America ("Allianz Life") making allegations similar As of 31 December 2021 2020 to those made in prior class actions regarding the sale of Allianz Life's 1 Short-term employee benefits 21 18 annuity products, including allegations of breach of contract and Post-employment benefits 5 6 violation of California unfair competition law. In one matter, the Court Share-based payment 19 21 denied class certification. The case, which continued as an individual Total 45 45 action, was settled between the parties with no effect on Allianz 1_Includes base salary, perquisites as well as short-term annual bonus. Group's financial position. The ultimate outcome of the remaining case cannot yet be determined. Since July 2020, multiple complaints have been filed in U.S. Existing provisions are mainly related to post-employment benefits Federal Courts and also in certain U.S. State Courts against Allianz and share-based payment. As of 31 December 2021, reserves for Global Investors U.S. LLC (“AllianzGI U.S.”) and in certain complaints, pensions and similar benefits for active members of the Board of against certain of AllianzGI U.S.’s affiliates, including Allianz SE and Management amounted to € 33 mn (2020: € 35 mn). Provisions for Allianz Asset Management GmbH (“Affiliate Allianz Defendants”), in share-based payment amounted to € 38 mn (2020: € 27 mn). connection with losses suffered by investors in AllianzGI U.S.’s The remuneration for the Supervisory Board of Allianz SE consists Structured Alpha funds (“Funds”) during the COVID-19 related market of a fixed remuneration, committee-related remuneration as well as downturn. The actions brought to date have included institutional attendance fees and reimbursement of expenses. These are investor plaintiffs and individual plaintiffs, with certain plaintiffs considered as short-term employee benefits. For the year ended asserting claims on behalf of putative classes. An investment 31 December 2021, the remuneration of the members of the consultant has also asserted third-party claims against AllianzGI U.S.. Supervisory Board was € 3 mn (2020: € 3 mn). Plaintiffs in the currently pending 26 actions have alleged losses of approximately USD 6.3 bn. In addition to the complaints filed to date, other investors in the Funds, or other third parties, may bring similar Transactions between Allianz SE and its subsidiaries that are to be actions. Plaintiffs in these actions have dismissed without prejudice all deemed related parties have been eliminated in the consolidation and claims against Affiliate Allianz Defendants, including Allianz SE and are not disclosed in the notes. Allianz Asset Management GmbH, with only one exception where Business relations with joint ventures and associates are set on an Allianz Global Investors Distributors LLC is kept as a defendant next to arm’s length basis. AllianzGI U.S.. AllianzGI U.S. continues to defend against the Due to reinsurance agreements with the joint venture Enhanzed allegations contained in the complaints. Reinsurance Ltd., Allianz SE recognized reinsurance assets and Upon request from the U.S. Securities and Exchange Commission deposits retained for reinsurance ceded amounting to each € 2.1 bn (“SEC”), AllianzGI U.S. has provided substantial information to the SEC for the year ended 31 December 2021. in connection with an SEC investigation of the Funds, and Allianz is fully cooperating with the SEC's ongoing investigation. In addition, the U.S. Department of Justice (“DOJ”) is continuing its 37 _ Litigation, guarantees, and other investigation concerning the Funds, and AllianzGI U.S. is also fully contingencies and commitments cooperating with the DOJ in the investigation and is continuing its own review of the matter. On 1 August 2021, in light of the DOJ investigation and based on information then available to Allianz, the Board of Management of Allianz Group companies are involved in legal, regulatory, and Allianz SE reassessed the Structured Alpha matter and came to the arbitration proceedings in Germany and a number of foreign conclusion, as also announced by Ad-hoc disclosure, that there is a jurisdictions, including the United States. Such proceedings arise in the relevant risk that the matters relating to the Funds could materially ordinary course of business, including, amongst others, their activities impact future financial results of Allianz Group. as insurance, banking and asset management companies, employers, In light of the discussions with plaintiffs and U.S. Governmental investors and taxpayers. While it is not feasible to predict or determine Authorities concerning the Structured Alpha matter and in anticipation the ultimate outcome of such proceedings, they may result in of settlements with major investors in the Funds Allianz decided, as substantial damages or other payments or penalties or result in announced by Ad-hoc disclosure on 17 February 2022, to recognize a adverse publicity and damage to the Allianz Group’s reputation. As a provision of € 3.7 bn for the fourth quarter of 2021. The provision result, such proceedings could have an adverse effect on the Allianz reflects the elements of the expected obligation in the Structured Group’s business, financial condition and results of operations. Apart Alpha matter, for which, as of today, a reliable estimate could be from the proceedings discussed below, Allianz SE is not aware of any determined. Final settlements with major investors were reached threatened or pending legal, regulatory or arbitration proceedings shortly thereafter and Allianz believes that these settlements represent which may have, or have had in the recent past, significant effects on a substantial majority of the Structured Alpha civil litigation exposure. its and/or the Allianz Group’s financial position or profitability. Material Discussions with remaining plaintiffs, the DOJ as well as the SEC are ongoing, and the timing and nature of any global or coordinated 174 Annual Report 2021 − Allianz Group

Non-financial Statement Page 175 Page 177

Non-financial Statement Page 175 Page 177