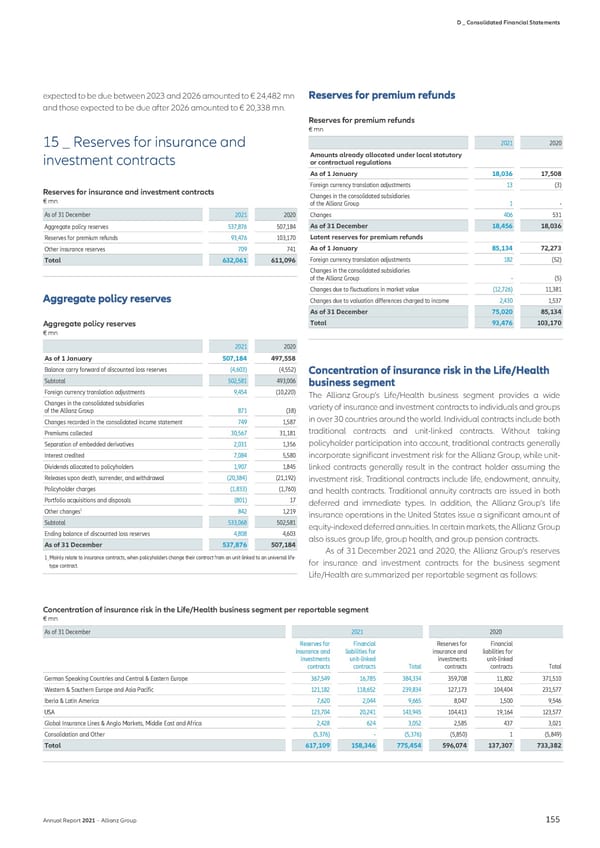

D _ Consolidated Financial Statements expected to be due between 2023 and 2026 amounted to € 24,482 mn and those expected to be due after 2026 amounted to € 20,338 mn. Reserves for premium refunds € mn 15 _ Reserves for insurance and 2021 2020 Amounts already allocated under local statutory investment contracts or contractual regulations As of 1 January 18,036 17,508 Foreign currency translation adjustments 13 (3) Reserves for insurance and investment contracts Changes in the consolidated subsidiaries € mn of the Allianz Group 1 - As of 31 December 2021 2020 Changes 406 531 Aggregate policy reserves 537,876 507,184 As of 31 December 18,456 18,036 Reserves for premium refunds 93,476 103,170 Latent reserves for premium refunds Other insurance reserves 709 741 As of 1 January 85,134 72,273 Total 632,061 611,096 Foreign currency translation adjustments 182 (52) Changes in the consolidated subsidiaries of the Allianz Group - (5) Changes due to fluctuations in market value (12,726) 11,381 Changes due to valuation differences charged to income 2,430 1,537 As of 31 December 75,020 85,134 Aggregate policy reserves Total 93,476 103,170 € mn 2021 2020 As of 1 January 507,184 497,558 Balance carry forward of discounted loss reserves (4,603) (4,552) Subtotal 502,581 493,006 Foreign currency translation adjustments 9,454 (10,220) The Allianz Group’s Life/Health business segment provides a wide Changes in the consolidated subsidiaries variety of insurance and investment contracts to individuals and groups of the Allianz Group 871 (38) Changes recorded in the consolidated income statement 749 1,587 in over 30 countries around the world. Individual contracts include both Premiums collected 30,567 31,181 traditional contracts and unit-linked contracts. Without taking Separation of embedded derivatives 2,031 1,356 policyholder participation into account, traditional contracts generally Interest credited 7,084 5,580 incorporate significant investment risk for the Allianz Group, while unit- Dividends allocated to policyholders 1,907 1,845 linked contracts generally result in the contract holder assuming the Releases upon death, surrender, and withdrawal (20,384) (21,192) investment risk. Traditional contracts include life, endowment, annuity, Policyholder charges (1,833) (1,760) and health contracts. Traditional annuity contracts are issued in both Portfolio acquisitions and disposals (801) 17 deferred and immediate types. In addition, the Allianz Group’s life Other changes1 842 1,219 insurance operations in the United States issue a significant amount of Subtotal 533,068 502,581 equity-indexed deferred annuities. In certain markets, the Allianz Group Ending balance of discounted loss reserves 4,808 4,603 also issues group life, group health, and group pension contracts. As of 31 December 537,876 507,184 As of 31 December 2021 and 2020, the Allianz Group’s reserves 1_Mainly relate to insurance contracts, when policyholders change their contract from an unit-linked to an universal life- for insurance and investment contracts for the business segment type contract. Life/Health are summarized per reportable segment as follows: Concentration of insurance risk in the Life/Health business segment per reportable segment € mn As of 31 December 2021 2020 Reserves for Financial Reserves for Financial insurance and liabilities for insurance and liabilities for investments unit-linked investments unit-linked contracts contracts Total contracts contracts Total German Speaking Countries and Central & Eastern Europe 367,549 16,785 384,334 359,708 11,802 371,510 Western & Southern Europe and Asia Pacific 121,182 118,652 239,834 127,173 104,404 231,577 Iberia & Latin America 7,620 2,044 9,665 8,047 1,500 9,546 USA 123,704 20,241 143,945 104,413 19,164 123,577 Global Insurance Lines & Anglo Markets, Middle East and Africa 2,428 624 3,052 2,585 437 3,021 Consolidation and Other (5,376) - (5,376) (5,850) 1 (5,849) Total 617,109 158,346 775,454 596,074 137,307 733,382 Annual Report 2021 − Allianz Group 155

Non-financial Statement Page 156 Page 158

Non-financial Statement Page 156 Page 158