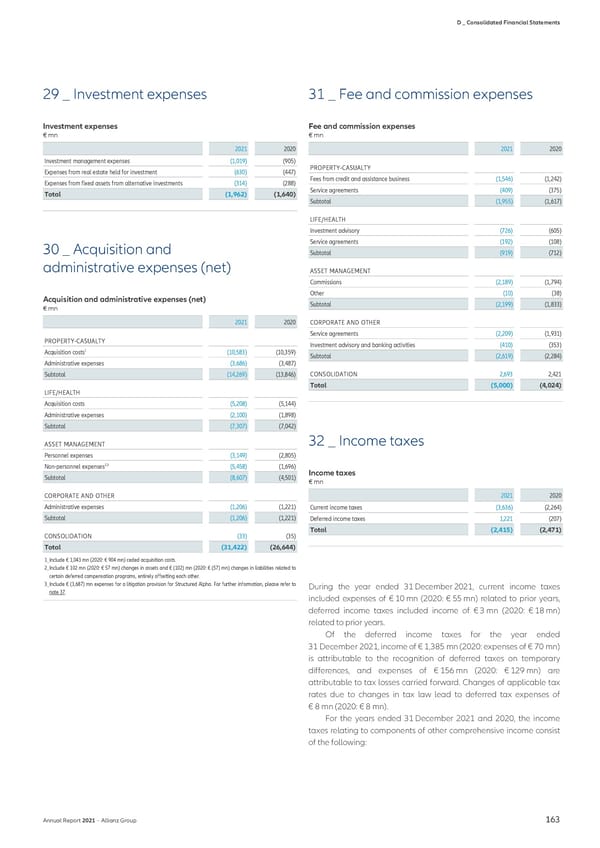

D _ Consolidated Financial Statements 29 _ Investment expenses 31 _ Fee and commission expenses Investment expenses Fee and commission expenses € mn € mn 2021 2020 2021 2020 Investment management expenses (1,019) (905) Expenses from real estate held for investment (630) (447) PROPERTY-CASUALTY Expenses from fixed assets from alternative investments (314) (288) Fees from credit and assistance business (1,546) (1,242) Total (1,962) (1,640) Service agreements (409) (375) Subtotal (1,955) (1,617) LIFE/HEALTH Investment advisory (726) (605) 30 _ Acquisition and Service agreements (192) (108) Subtotal (919) (712) administrative expenses (net) ASSET MANAGEMENT Commissions (2,189) (1,794) Acquisition and administrative expenses (net) Other (10) (38) € mn Subtotal (2,199) (1,833) 2021 2020 CORPORATE AND OTHER Service agreements (2,209) (1,931) PROPERTY-CASUALTY Investment advisory and banking activities (410) (353) 1 Acquisition costs (10,583) (10,359) Subtotal (2,619) (2,284) Administrative expenses (3,686) (3,487) Subtotal (14,269) (13,846) CONSOLIDATION 2,693 2,421 Total (5,000) (4,024) LIFE/HEALTH Acquisition costs (5,208) (5,144) Administrative expenses (2,100) (1,898) Subtotal (7,307) (7,042) ASSET MANAGEMENT 32 _ Income taxes Personnel expenses (3,149) (2,805) Non-personnel expenses2,3 (5,458) (1,696) Subtotal (8,607) (4,501) Income taxes € mn CORPORATE AND OTHER 2021 2020 Administrative expenses (1,206) (1,221) Current income taxes (3,636) (2,264) Subtotal (1,206) (1,221) Deferred income taxes 1,221 (207) Total (2,415) (2,471) CONSOLIDATION (33) (35) Total (31,422) (26,644) 1_Include € 1,043 mn (2020: € 904 mn) ceded acquisition costs. 2_Include € 102 mn (2020: € 57 mn) changes in assets and € (102) mn (2020: € (57) mn) changes in liabilities related to certain deferred compensation programs, entirely offsetting each other. 3_Include € (3,687) mn expenses for a litigation provision for Structured Alpha. For further information, please refer to During the year ended 31 December 2021, current income taxes note 37. included expenses of € 10 mn (2020: € 55 mn) related to prior years, deferred income taxes included income of € 3 mn (2020: € 18 mn) related to prior years. Of the deferred income taxes for the year ended 31 December 2021, income of € 1,385 mn (2020: expenses of € 70 mn) is attributable to the recognition of deferred taxes on temporary differences, and expenses of € 156 mn (2020: € 129 mn) are attributable to tax losses carried forward. Changes of applicable tax rates due to changes in tax law lead to deferred tax expenses of € 8 mn (2020: € 8 mn). For the years ended 31 December 2021 and 2020, the income taxes relating to components of other comprehensive income consist of the following: Annual Report 2021 − Allianz Group 163

Non-financial Statement Page 164 Page 166

Non-financial Statement Page 164 Page 166